Bank of Canada Monetary Policy Decision

Bank of Canada Monetary Policy Decision

- Source

- Bank of Canada

- Source Link

- https://www.bankofcanada.ca/

- Next Release(s)

- March 18th, 2026 9:45 AM

-

April 29th, 2026 9:45 AM

-

June 10th, 2026 9:45 AM

-

July 15th, 2026 9:45 AM

-

September 2nd, 2026 9:45 AM

-

October 28th, 2026 9:45 AM

-

December 9th, 2026 9:45 AM

Latest Updates

-

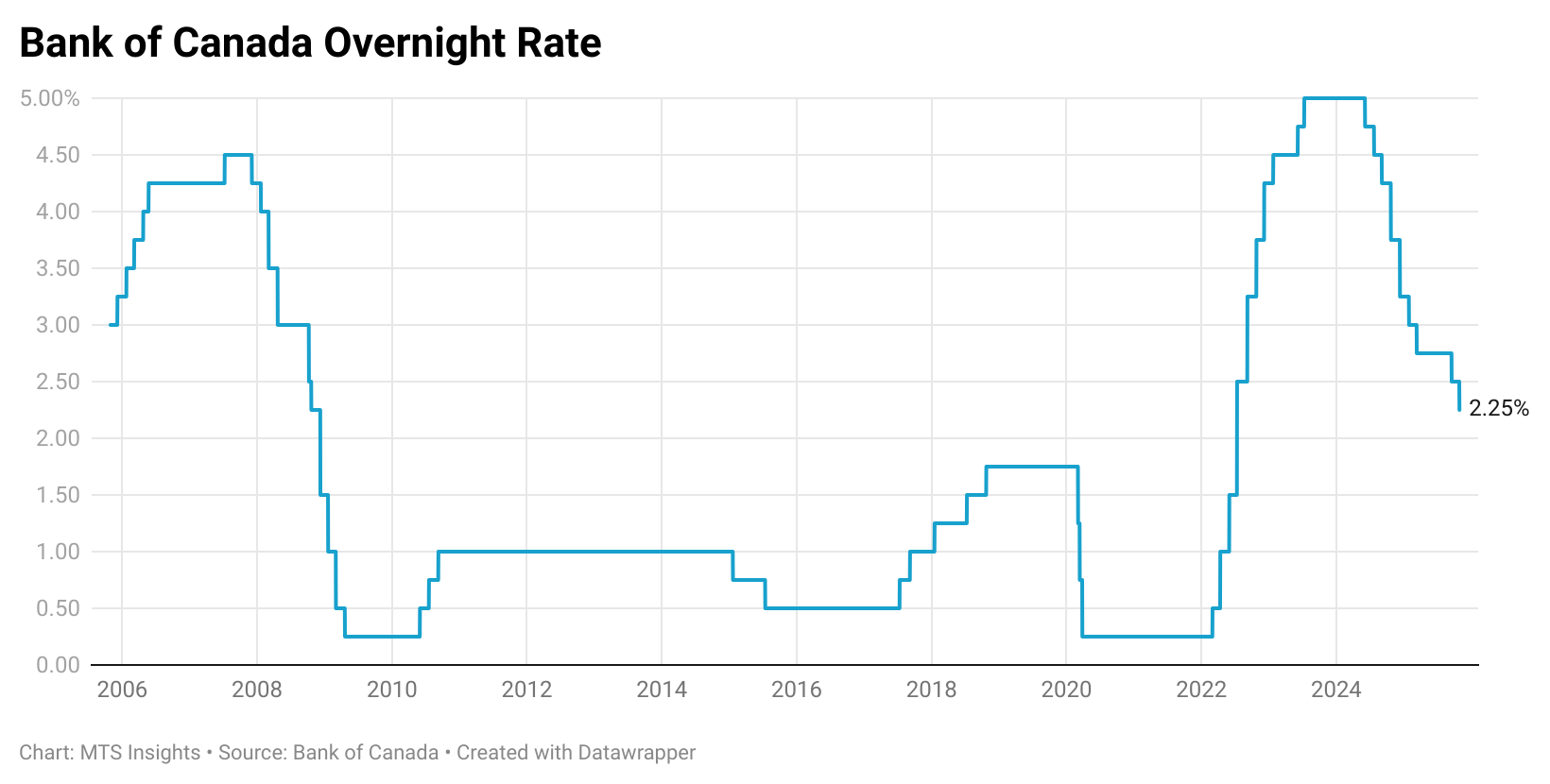

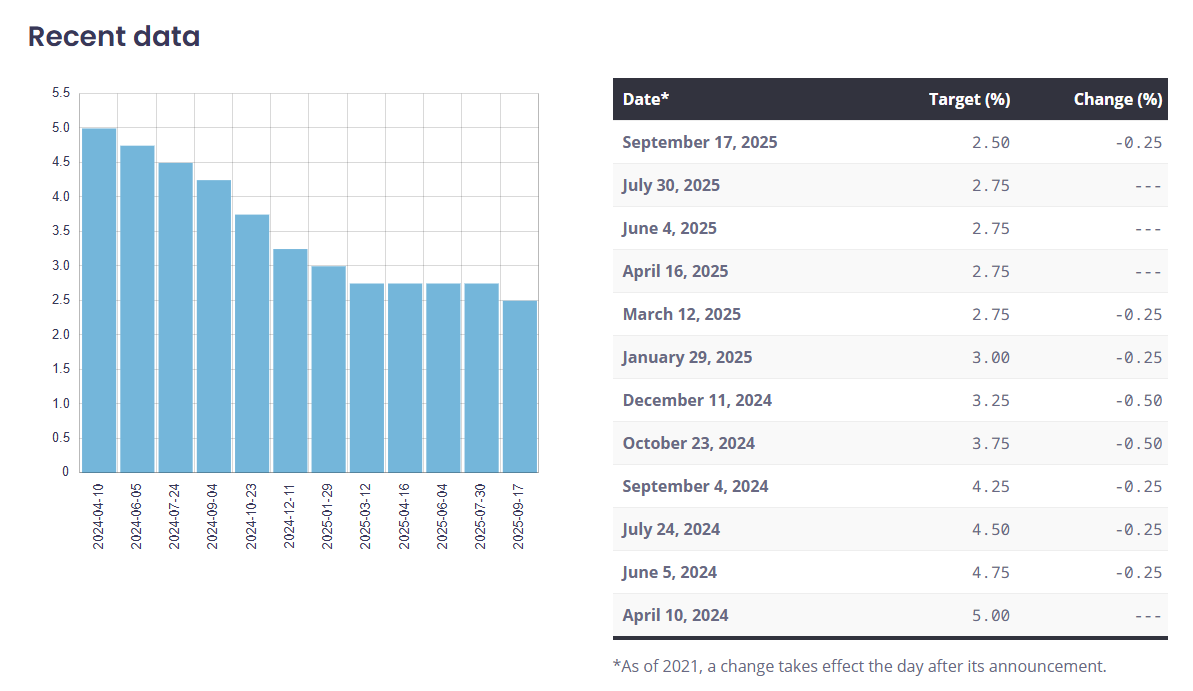

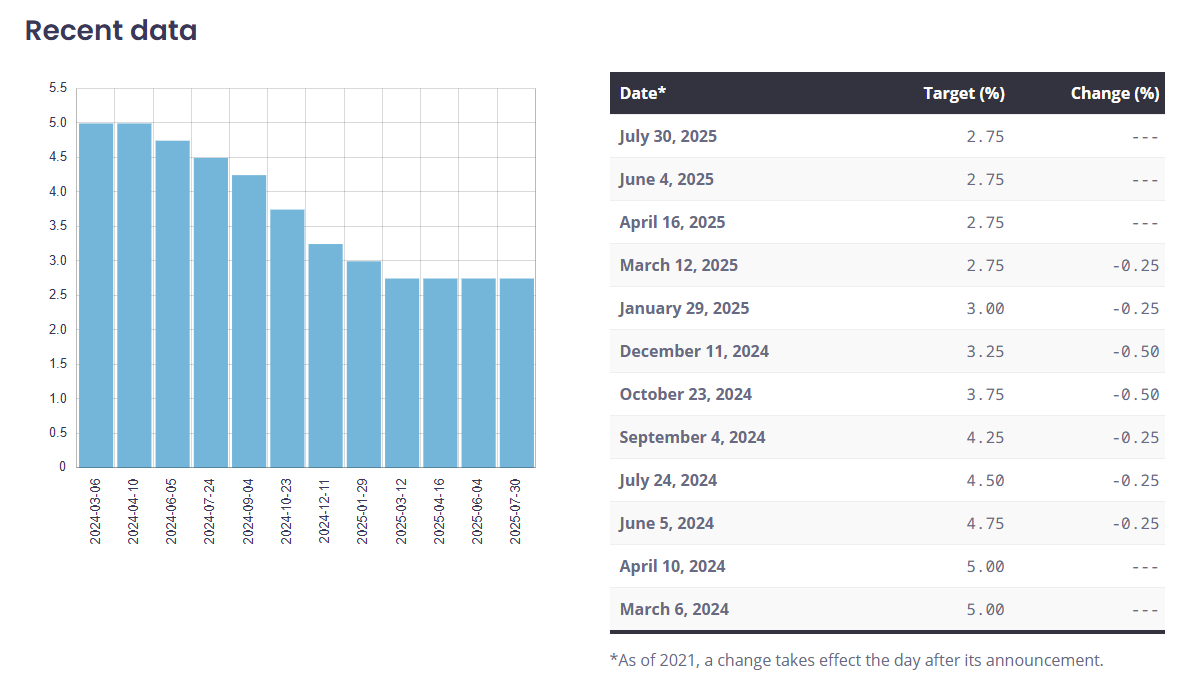

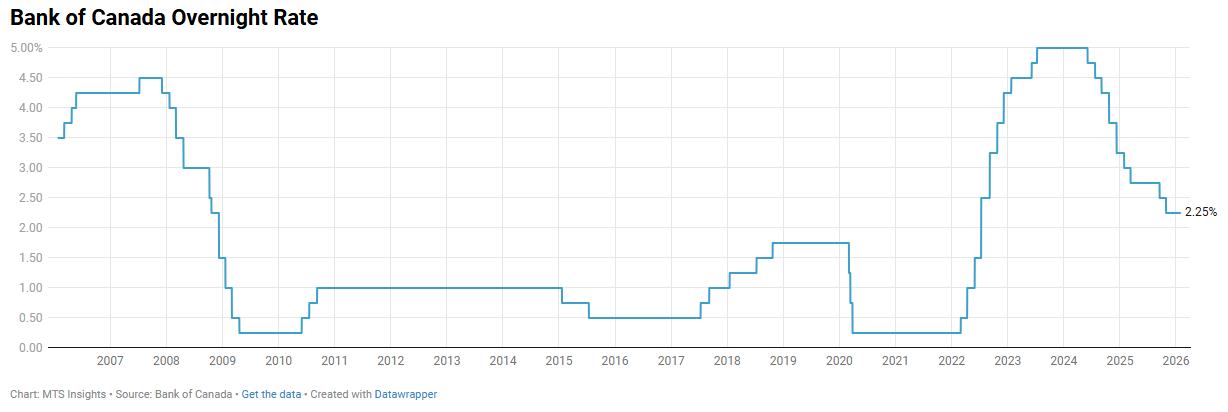

The Bank of Canada held its policy rate at 2.25% in January 2026, keeping settings unchanged as growth slows and inflation stays near target.

-

The overnight rate remained 2.25% (Bank Rate 2.5%, deposit rate 2.20%), indicating continued policy stability amid heightened trade and geopolitical uncertainty.

-

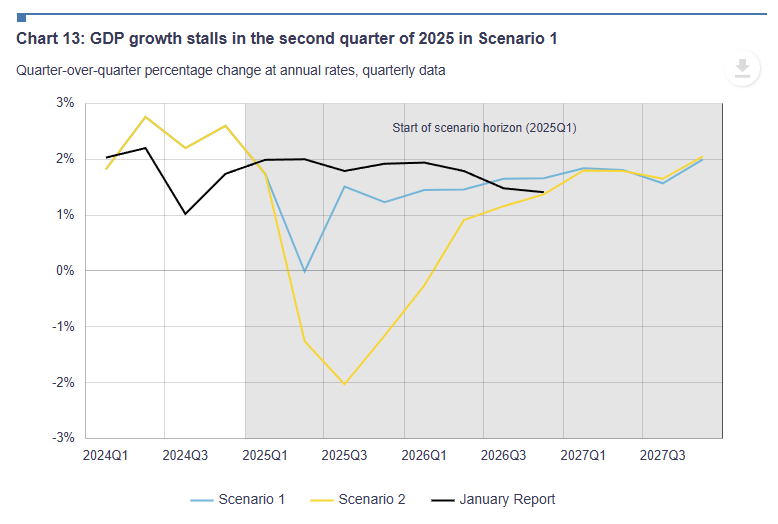

Global growth is projected to average about 3%, supported by solid U.S. consumer spending and AI investment, service-sector strength in Europe, and offset by gradually slowing domestic demand in China.

-

U.S. tariffs are pushing inflation higher in the near term, though the Bank expects these effects to fade later in the year, suggesting temporary trade-related price pressure.

-

Canada’s GDP growth likely stalled in Q4 after a strong Q3, with exports weighed down by U.S. trade restrictions while domestic demand shows early signs of improvement.

-

Employment has risen recently, but the unemployment rate remains elevated at 6.8%, and few firms report plans to increase hiring, pointing to continued labor market slack.

-

The Bank projects Canadian growth of 1.1% in 2026 and 1.5% in 2027, broadly unchanged from October, reflecting modest near-term momentum as the economy adjusts to trade frictions.

-

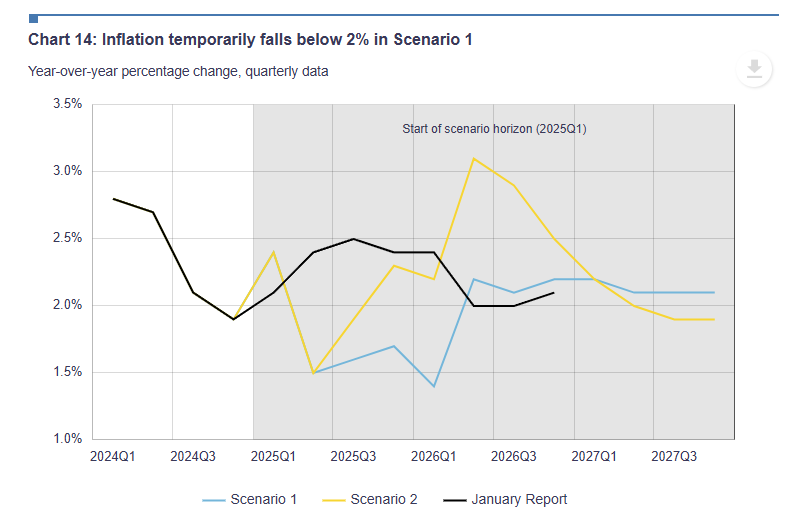

CPI inflation rose to 2.4% YoY in December, boosted by tax-related base effects, while core inflation eased to around 2.5%, aligning underlying price pressures closer to the 2% target.

-